Categories > Guides and Tips

A Guide on How to Pay Taxes in Singapore

- How to Pay for Taxes in Singapore in 10 Easy Steps

- Step 1: Determine Your Tax Residency Status

- Step 2: Get a Tax Identification Number

- Step 3: Understand Your Income Sources and Reporting Obligations

- Taxable Income

- Non-Taxable Income

- Determine Tax Deductions, Reliefs, and Rebates

- Step 5: Log in to myTax Portal on the IRAS Website

- Step 6: Access Your Tax Form

- Step 7: Declare Your Income

- Step 8: Claim Deductions and Reliefs

- Step 9: Review and Validate

- Step 10: Submit Your Tax Return

- How do I pay my Singapore income tax with PayNow?

- Step 1: Log in to myTax Portal and Choose the Tax to Pay

- Step 2: Use the PayNow App

- Step 3: Review the Details and Confirm the Payment

- Step 4: Receive the Payment Confirmation and Update Status

- How to Pay Taxes in Singapore via DBS iBanking

- Step 1: Log in to DBS iBanking

- Step 2: Go to "Pay Bills" and "Pay Tax Online"

- Step 3: Select "Government & Statutory Organization"

- Step 4: Choose "Inland Revenue Department" as Payee

- Step 5: Select the Account and Enter Your Details

- Step 6: Confirm and Submit the Payment Details

A few years ago, my buddy had just moved to Singapore from another country and was beginning her work as a fresh graduate. She knew nothing about managing her taxes in this new country when she started getting her first paychecks.

Luckily, I was there to help her successfully manage her tax obligations.

Motivated by this experience, I devised a quick guide to help you navigate Singapore’s tax system if you’re overwhelmed.

How to Pay for Taxes in Singapore in 10 Easy Steps

| Difficulty | Easy ●●○○○ |

| Number of steps | 10 |

| Time needed | Several weeks |

| Things you need | To apply for a Tax Identification Number: • Passport or NRIC (National Registration Identity Card) for identification purposes • Employment Pass, Dependant’s Pass, or any other relevant work permit documents • Letter of Offer or Employment Contract from your employer • Proof of local residential address, such as a utility bill or rental agreement • Any additional supporting documents requested by the authorities. For actual tax filing: • SingPass or IRAS Personal Identification Number (PIN)Form IR8A (provided by your employer) • Employment contracts • Bank statements • Any other relevant supporting documents |

Paying taxes is now accessible for every Singaporean since we only need an Internet connection and a device to access the Inland Revenue Authority of Singapore (IRAS) website. Make sure to prepare the necessary documents before logging in.

First, determine if your salary fits the minimum to pay income tax in Singapore.

The minimum salary should be $20,000 annual income. If you earn lower than this, you’re exempted from paying taxes.

You may need to file for an income tax return even if you receive a No-Filing Service (NFS) letter or SMS from the IRAS. One instance when you have to do so is when your relief claims have changed since the previous year.

If you want to learn more about Income Tax Return filing, you can visit this page.

Now if you earn more than $20,000 a year, the next question to ask is “How do you pay taxes?”

Step 1: Determine Your Tax Residency Status

Knowing your tax residency status in Singapore is the first step to understanding your tax obligations. Your tax residency status as an employee will impact the types of income you must declare and the tax rates that apply to you.

I summarized the criteria the IRAS uses to determine tax residency statuses:

1. Duration of Stay

- If you spend 183 days or more in Singapore annually, you’re a tax resident.

- Alternatively, you will also be regarded as a tax resident if the sum of your cumulative stays over several years equals 183 days or more.

2. Permanent Home

- If you own or rent a permanent residence in Singapore (such as a house or apartment), it implies your plan to establish residency in the country.

3. Employment

- If you have a job in Singapore that you anticipate keeping for at least six months, it can be a sign that you want to establish residency.

4. Family

- If you intend to establish residency, having a spouse and/or children who live in Singapore may be a factor.

5. Economic and Social Ties

- Your financial and social ties to Singapore, including your participation in clubs, professional groups, or community volunteer work, may be considered when determining your resident status.

6. Schooling Arrangement for Children

- If you enroll your kids in Singaporean schools, it can signify that you want to establish residency.

7. Intentions

- Your intentions regarding your residency in Singapore may be considered when assessing your tax resident status.

For example, if you’re a foreigner who intends to stay in Singapore for three or more years, you’re considered a tax resident and will be taxed from the first year of your stay.

Step 2: Get a Tax Identification Number

You need a Tax Identification Number (TIN) provided by IRAS to file your taxes and communicate with the tax authorities.

The procedure for applying for a TIN is straightforward and comprises giving the required documentation and information to IRAS per their instructions.

- Verify that you can receive a Singapore TIN by checking the eligibility requirements. People working or engaging in other income-generating activities in Singapore typically need a TIN.

- Gather the documentation that you’ll need to support your TIN application. Refer to the table above under the “Things You Need” section.

- Submit your TIN application to the IRAS via online or in-person channels.

- Online: Sign up for an account on the IRAS website. Find the TIN application section on the website.

Accurately complete the essential fields and electronically attach the required documents. To finish the application procedure, follow the instructions given by the website.

- In-person: If an online application is unavailable or inappropriate for your situation, you can go to the IRAS Taxpayer Service Center in person.

You can book an appointment or find service centers near you via https://www.iras.gov.sg/contact-us/locate-us.

Bring the necessary documentation and a filled application form. You will be guided through the filing procedure by the IRAS personnel.

- It would be best to wait for the IRAS to process your application after submitting your TIN application. Although the processing time may vary, expect to get it after a few weeks.

- Your Singapore TIN will be sent to you via mail or on the IRAS website once your application has been approved. Keep a copy of your TIN on hand for the next steps of tax filing.

Step 3: Understand Your Income Sources and Reporting Obligations

This step will be the continuation of step 1. Once you know your tax residency status, you will understand what your source and obligations are when it comes to taxes.

As an employee, it’s crucial to comprehend the different parts of your income, such as your base pay, bonuses, allowances, and benefits-in-kind.

Learn about your reporting responsibilities, such as disclosing all income received—including foreign income if appropriate. Detailed instructions on the categories of income to declare and how to do so effectively are provided by IRAS.

Taxable Income

| Types of Taxable Income | Examples |

| Income received in Singapore | Income that comes from your job in SingaporeIncome from your business that’s operating in SingaporeIncome from your investments like rental payments and dividendsProfits from your properties |

| Income received in Singapore coming from outside the country | Remittances from other countries going to SingaporeDebt payments for your business that’s operating in SingaporePayments for products that are brought to Singapore |

Non-Taxable Income

| Types of Taxable Income | Examples |

| Capital Gains | Fixed asset (vehicles, land, etc.) salesCapital transaction foreign exchange earnings |

| Tax-Exempted Income | Specific income from a shipping enterpriseSome foreign service income and dividends Disposed equity investments earned from a company |

Find more details on taxable and non-taxable income here.

Determine Tax Deductions, Reliefs, and Rebates

Several exemptions and reliefs are available in Singapore that might assist you in lowering your taxable income.

Learn about tax deductions and exemptions, including payments to the CPF (Central Provident Fund), permissible donations, and educational costs.

There are many kinds of deductions, reliefs, and rebates that you can qualify for.

Tax Reliefs

- Handicap Earned Income Relief

- Unemployed Spouse and Handicapped Spouse Reliefs

- Foreign Domestic Worker Levy Relief (FDWL)

- Central Provident Fund Relief for Employees and Self-Employed (CPF)

- NSman Relief for Self, Wife, and Parent

- Dependent Parent and Handicapped Parent Relief

- Grandparent Caregiver Relief

- Qualifying Child and Handicapped Child Reliefs

- Working Mother’s Child Relief (WMCR)

- Handicapped Sister and Brother Reliefs

- Life Insurance Relief

- Compulsory and Voluntary MediSave Contributions

- Course Fees Relief

- Central Provident Fund Cash Top-up Relief

- SRS Contributions and Tax Relief

Tax Rebates

- Personal Tax Rebate

- Parenthood Tax Rebate

Tax Deductions

- Rental Expenses

- Donations

- Self-Employed Persons

- Partnerships

- Employment Expenses

You can find more information here.

Step 5: Log in to myTax Portal on the IRAS Website

Ensure you have access to a computer or mobile device and a stable Internet connection. Go to the e-Filing section of the official IRAS website.

You can use your SingPass or the IRAS PIN to access the IRAS myTax Portal. You can sign up for a SingPass or IRAS PIN on the myTax Portal if you don’t have one yet.

Step 6: Access Your Tax Form

Access your tax form (Form B1) after logging in, depending on your income sources and tax reliefs.

Although the system might pre-fill some areas with data provided by your employer and the government, it’s still essential to check and verify that the information is correct.

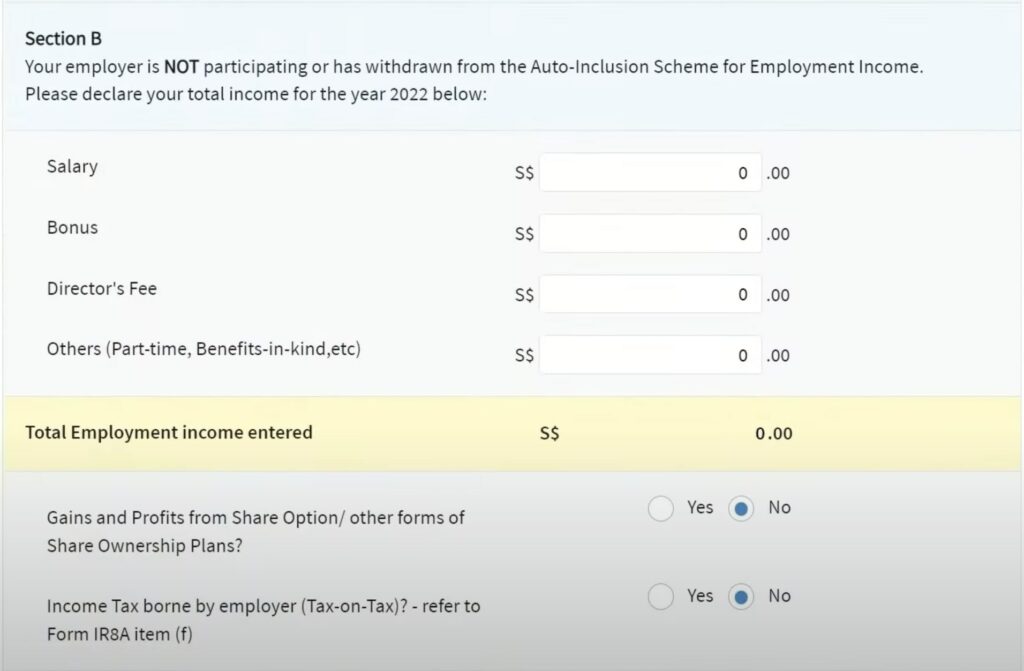

Step 7: Declare Your Income

Declare your taxable income from your job, business, rental property, dividends, and other sources. Follow the directions on the form and accurately fill out all the required information.

Step 8: Claim Deductions and Reliefs

Declare any deductions and exemptions you are entitled to, such as those for qualified childcare expenses, charitable contributions, Central Provident Fund (CPF) payments, and employment expenses.

Make sure you have the necessary supporting documentation on hand for reference.

| Relief, Deduction, and Rebate | Requirements |

| 1. Handicapped-related Tax Reliefs | • Filled-out Handicapped-Related Tax Relief form • For the doctor’s assessment, you need the dependent’s or your medical records including lists of medications. |

| 2. FDWL Relief, CPF Relief for Employees and Self-Employed, Grandparent Caregiver Relief, WMCR Relief, Life Insurance Relief, Course Fees Relief | • For e-filing, you only need to log-in to the myTax Portal and enter your claim. You may find the instructions here. • For paper filing, you need to complete the B1 and B forms and complete the items under the tax relief you want to claim. Then, submit them to an IRAS office. |

| 3. NSman Relief for Self, Parent, or Wife | • There are no requirements or a need to claim this relief, as you will automatically have tax deductions if you are eligible. |

| 4. SRS Tax Relief | • You don’t need to submit any documents or claim this tax relief. It will automatically reflect in your tax statement depending on the information provided by the SRS operator. |

| 5. Deductions on Rental Expense | • For precedent partners, report your rental income with Form P. • For individual partners, report rental income using Form B or B1. You may find the details of reporting rental income here. |

| 6. Deductions on Employment Expenses | • For allowable employment expenses not reimbursed by your employer, you should enter your claim via the “Employee” section in your ITR. • The IRAS may request documentation including receipts, invoices, or vouchers. So make sure you keep them for at least 5 years (e.g. the IRAS may request receipts in 2028 for deductions you claimed in 2023). |

Step 9: Review and Validate

Make sure the data you submit is accurate and comprehensive by reviewing it once or twice. Verify once more that all income, deductions, and reliefs are accurately inputted and recorded.

Step 10: Submit Your Tax Return

Once you’ve verified the information, electronically file your tax return through the myTax Portal. After successful submission, you will get an acknowledgment notification and email.

How do I pay my Singapore income tax with PayNow?

Step 1: Log in to myTax Portal and Choose the Tax to Pay

Enter myTax Portal using Corppass or Singpass. Select “Pay Taxes” from the main menu and select the specific tax type you intend to pay. In your case, it should be Individual Income Tax.

Next, pick the “Pay” option to the right of the chosen tax type.

Step 2: Use the PayNow App

Launch the PayNow app to access its payment service. Make sure your Internet connection is stable.

Check the PayNow app for the “Scan QR Code” feature. Using this service, you can pay your taxes by scanning the unique QR code issued by the IRAS.

Step 3: Review the Details and Confirm the Payment

Verify the payment information on your screen, including the recipient details, the TIN, and the amount. Before proceeding, make sure the data is correct.

Then, confirm the tax payment by following the on-screen instructions in your PayNow or banking app.

Step 4: Receive the Payment Confirmation and Update Status

You’ll get a payment confirmation once the transaction is successful on your PayNow app. Keep a copy of the proof if possible.

To change the payment status, return to the IRAS website or, if applicable, your tax filing portal. Make sure your tax records accurately reflect your tax payment.

How to Pay Taxes in Singapore via DBS iBanking

Step 1: Log in to DBS iBanking

Go to the DBS iBanking website and sign in with your login information.

Step 2: Go to “Pay Bills” and “Pay Tax Online”

Go to the “Pay Bills” section after logging in and choose “Pay Tax Online” from the options.

Step 3: Select “Government & Statutory Organization”

Select “Government & Statutory Organization” as the payment category in the “Category” dropdown menu.

Step 4: Choose “Inland Revenue Department” as Payee

Choose “Inland Revenue Department” as the specified payee for your tax payment in the “Payee” dropdown menu.

Step 5: Select the Account and Enter Your Details

Select the bank account you want to make the payment from. Add your account details, payment sum, and preferred date.

Check the entered information to make sure they’re accurate. Once confirmed, click the “Next” button to continue.

Step 6: Confirm and Submit the Payment Details

Examine the payment information shown on the confirmation page. Ensure all details are accurate, including the payee account and payment sum.

Once you’ve verified the information, submit the transaction by clicking the appropriate button, typically “Submit” or “Confirm.”

A confirmation message stating that the tax payment is successful will appear.